Employees routinely complain when they are assigned the job of preparing expense reports. The procedure can be cumbersome, lengthy and rather puzzling. This post will explain what expense reports are and how to handle them. Besides, which applications are useful for tracking spending, and provide templates and tools to make things easier? We will also swiftly discuss the primary reasons why people have anxiety expense reports and how to handle these attitudes.

What Are Expense Reports?

An expense report is a statement written and submitted to an employer that details expenses made during work. These are the actual expenses that cover transportation, meals, lodging, materials, equipment, and a variety of other business purchases. The expense report is to explain to an employer why an employee spent too much money on the company business.

Typically, an expense report includes the following information:

- Date of the expense: At which particular period the expenditure took place.

- Description of the expense: What the expense was for such as transport or meals.

- Amount spent: The overall economic cost for each one of those items.

- Receipts: Documents which should be attached to each entry, as the proved purchase.

- Account coding: The spending is classed as a subsection of the total budget, or it is allotted to a specific project.

Since these reports are useful in keeping track of how a business is spending its money. Furthermore, it ensures that employees receive the appropriate amount of money for which they have been reimbursed. But many individuals dislike preparing them.

Why Nobody Will Like to Prepare an Expense Reports?

Time-Consuming Process

It can be rather time-consuming to do an expense report. Many personnel must go through piles of receipts, sort spending, and ensure that they meet company standards. This might be extremely scary because you may discover that multiple charges were incurred during the same trip or work.

Lack of Clarity in Policies

A lot of industries use rather vague and often flexible policies regarding employee expenses. Some employees may be unsure if they can be paid back or not.

Such ambiguity makes it difficult to prepare a reliable report with optimum precision.

Manual Entry Errors

Using the data entry approach frequently leads to errors, such as those seen in the withholds expense reports example. It’s difficult enough to deal with the time-consuming and sometimes proactive nature of payment processing. Besides, adding statistics or spelling errors might result in delayed payments or outright rejection of claims. This adds another degree of strain on the employee, who would simply like to be reimbursed for her costs.

Considered a burden

Many employees believe they have yet additional forms to complete while already preoccupied with their responsibilities. People dislike this process for a variety of reasons, including the fear that it would limit their time for other important tasks.

How To Process Expense Reports?

Processing expense reports involves several steps that both employees and employers must follow:

- Collect Receipts: Employees should accumulate receipts while undertaking other work related activities as they accrue the expenses.

- Complete the Report: In particular, staff use a template or software to fill out an expense report, filling it out with all the necessary information.

- Submit for Approval: Once prepared, the report is forwarded to a manager or finance department concerned for approval.

- Review and Approve: Before approving the report, the approver verifies that it is accurate and complies with the company’s criteria.

- Reimbursement: Once accepted, the reimbursement is processed through the finance department’s payroll or via direct check.

Companies that implement this planned strategy can remove the unnecessary time that frustrates employees while also shortening the working process.

Best Expense Tracking Apps

Several apps are available to simplify the management of expenditure reports and make tracking expenses easier:

- Expensify: One of the app’s features is the ability to scan receipts and their data. Besides, it generates expenditures based on receipt data submitted.

- Zoho Expense: The major offered features by Zoho include receipt scanning, multiple currencies, and accord with accounting software.

- Concur: A rather popular tool that includes reliable functions for travel arrangements and cost management.

- Fyle: A system that consists of a mobile application along with a web application that harmonizes with existing accounting solutions.

These apps not only save time but also reduce the possibility of errors while manually entering data.

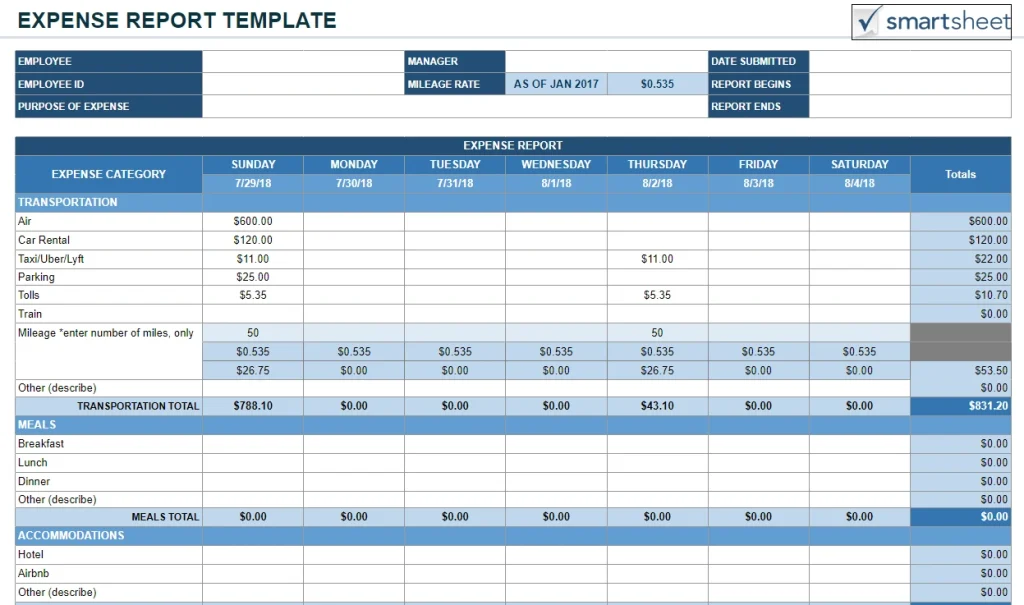

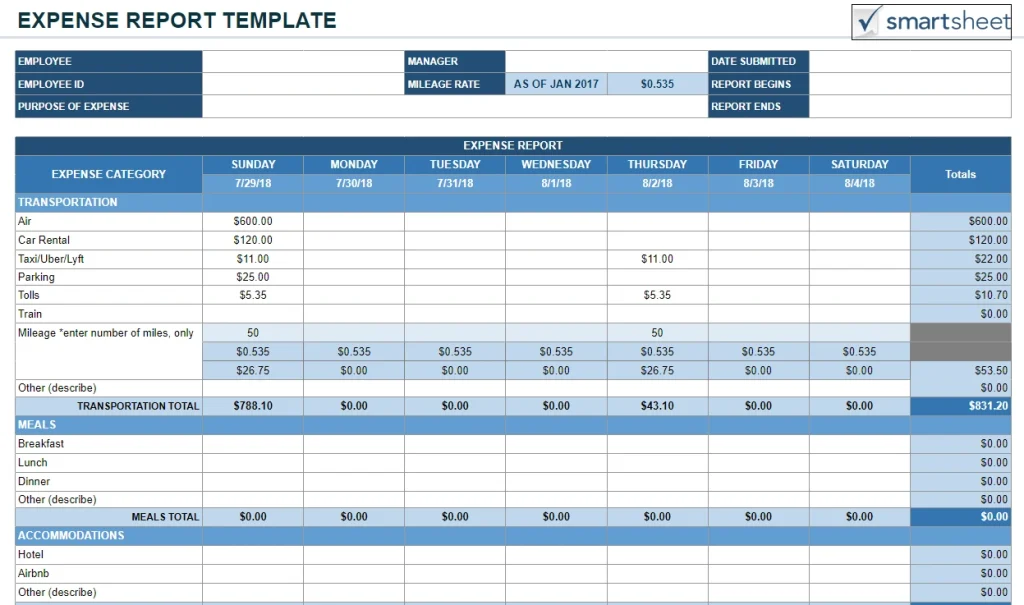

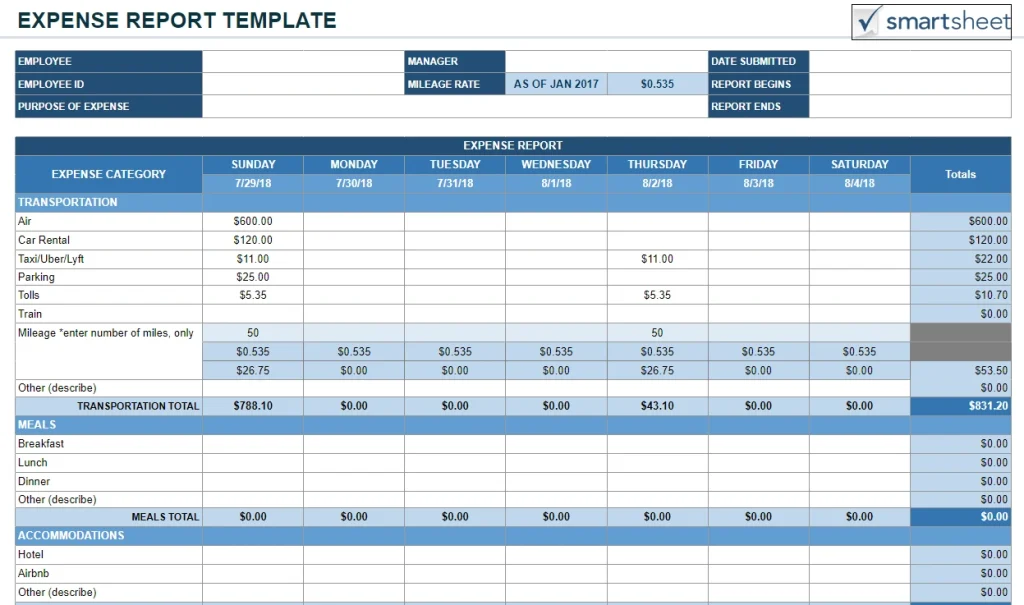

Expense Report Template

Having a template developed can greatly help simplify an expense report’s writing process. Generally, a well-organized template has parts for:

- Date

- Description

- Amount

- Category of expense (for example, transport, food and beverages)

- Receipt attachment

These can be created in Microsoft Excel or Google Spreadsheets, or downloaded from a variety of websites. The advantage of using a template is that an employee can ensure that all of the key components are included in a report. It helps to convey a consistent message throughout the company.

Expense Reports Software

Investing in dedicated software for managing expense reports can greatly enhance efficiency within an organization:

- QuickBooks: Originally developed as an accounting tool, QuickBooks contains options for tracking worker expenses and creating related reports.

- Sage Intacct: They offer superior features of handling the organizations’ financial needs with features such as expense tracking.

- Ramp: A very new company in the market. It automates expenditure management and provides insights into a company’s spending decisions.

These options help to accelerate procedures, reduce errors, and provide useful information regarding expenses.

Free Expense Report Template

For those looking for cost-effective solutions, numerous free expense roport templates are available online:

- Google Sheets Templates: Google provides many templates to be used depending on the particular needs of the user.

- Microsoft Excel Templates: Other templates for the Excel program are available, allowing you to track spending under your preparations.

- Online Resources: Many sites, including Vertex42, provide free templates customized for various sorts of expenses.

The fact these sources are free means that businesses can adopt structured reporting techniques without having to bear costs.

Employee Expense Reports

Employee expense claims are critical components of ensuring compliance with proper expenditure procedures inside company organizations. They provide impressions of how some employees use corporate finances and can identify prospective areas where costs can be decreased.

To thoroughly manage its employees’ spending, it is necessary to create standard employee expense reports.

- Budget Management: Periodically reviewing all employee expense reports will help a company determine how much was spent. Besides, where to make the necessary changes.

- Tax Compliance: Thus, proper reporting will help firms satisfy all of the legal requirements for taxes by clearly recording all permissible expenses.

- Identifying Trends: When a company tracks its employees’ expenses over time, it can identify spending trends. It will help it budget for the future.

Conclusion

Everyone knows that creating expenditure reports is a chore that takes a lot of time and can be confusing. However, understanding one’s advantages as an employer and employee is critical. High-quality software solutions, appropriate processes, apps, and crystal-clear templates can all reduce the stress that comes with these important tasks.

Accurate expense reporting is crucial not just for an independent employee, but also for the entire firm. It is considerably significant too. By doing this, companies guarantee employee accountability. Additionally, they acknowledge the financial effort needed to complete jobs as well as the effort that goes into those tasks.